With the rapid development of China’s economy and the continuous improvement of international influence, China is attracting more and more foreigners to invest, work and live in the country.

To live and work in a permanent basis in China, green card would be the right choice which make the holder of China permanent residence entitled to many of the same benefits as a Chinese citizen.

- Permanent residence card holders can work in China without a foreigner’s work permit, they can enjoy the same treatment as Chinese citizens in terms of purchasing, applying for driving license, sending their children to school, transportation, accommodation registration and other aspects.

- You may apply for a wide variety of jobs. Permanent Residence card holders experience greater job opportunities than those on a China work visa.

- Permanent residence card holders who work in China may participate in corresponding social insurance according to the law, deposit and enjoy the benefits of the Provident Fund.

- Permanent residence card holders who live in China without a job can participate in the medical and endowment insurance in accordance with the regulations, enjoying social insurance benefits.

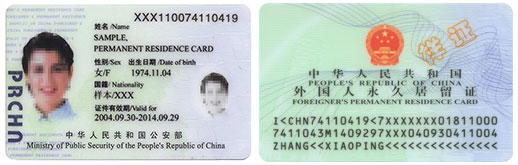

Permanent Residence Card

To apply for permanent residence, you should provide a foreign non-criminal record, the record should be issued by Department of Justice, the police department or sheriff’s office in your country, and should be legalized by the Chinese Embassy or Consulate. Also, it should be translated to Chinese by qualified Chinese translation institution, a photocopy of the business license of institution is required. Our company can help you apply for non-criminal record of the United States, Canada, Australia and the United Kingdom, meanwhile submit the criminal background check to Embassy or Consulate for legalization.

Aofan Consulting can assist you in applying for non-criminal record of the United States, Canada, Australia, and the United Kingdom, meanwhile submit the criminal background check to Embassy or Consulate for legalization.

Application procedures on Chinese Permanent Residence

1. Get your documents for request of Permanent Residence prepared.

2. Submit the documents to the Exit-Entry Administration Office of the Public Security Bureau in the place of your long-term residence or the main investment place.

3. The accepting authorities shall complete the investigation and submit the qualified applications to the examining and approving authorities.

4. The examination and verification authorities shall complete the preliminary examination and verification procedures within 2 months. Then the approved application shall be submitted to the Ministry of Public Security for examination and final approval. The Ministry of Public Security will issue permanent resident identity cards to foreigners who are approved to reside permanently in China.

The applicant shall faithfully fill in the Form of Application for Foreigner's Permanent Residence in China and submit the following materials:

1. Copy of valid passport or other ID that may be used instead of the passport;

2. Physical examination report issued by Chinese health quarantine office or foreign health quarantine organizations recognized by the Chinese embassy or consulate;

3. Certificate of foreign no criminal record legalized by Chinese embassy or consulate;

4. Four recent full-face color photos ( 2 by 2 inches, bareheaded) of the applicant;

5. Other relevant materials provided herein.

- An applicant who makes direct investment in China with stable operation and a good tax paying record for three successive years shall submit a certificate of approval for the foreign-invested enterprise, certificate of registration and a joint annual inspection certificate, report on the verification capital and personal tax payment receipt in addition.

- An applicant holding couple reunion visa shall, in addition, submit his (her) Chinese spouse’s registered permanent residence certificate or foreign spouse’s Foreigner’s Permanent Residence Card, marriage certificate, and a notarized certificate of source of subsistence and house leasing certificate or muniments of title. The above-mentioned certificates issued by foreign country shall be subject to the authentication of the Chinese embassy or consulate.

- An applicant holding parent-child reunion visa shall, in addition, submit his Chinese parent’s registered permanent residence certificate or foreign parent’s Foreigner’s Permanent Resident Card, his birth certificate or parentage certificate and, in the case of an adopted child, the adoption certificate in addition. The above-mentioned certificates issued by foreign country shall be subject to the authentication of the Chinese embassy or consulate.

Here are the primary benefits of a Green Card:

1. Employment: For employment in China, “Foreigner Work Permit” is not required.

2. Domestic residence: The period of residence in China will not be restricted. You can enter and exit China with a valid passport and the “Permanent Residence Permit for Foreigners”, and you do not need to go through other procedures such as visas; spouses and immediate family members can apply for it in accordance with relevant regulations. Corresponding visa, residence permit or “Permanent Residence Permit for Foreigners”.

3. Education: The holder’s accompanying children are enrolled in the compulsory education stage. Those who meet the conditions can enjoy the relevant policies and treatment stipulated by the state. They can enroll in the nearest school, handle the transfer in and out procedures. Fees other than those stipulated by the state are not required to be charged.

4. Social insurance: You can go through various procedures for participating in social insurance. Those employed in China shall participate in various social insurances in accordance with relevant regulations.

5. Investment: You can establish a foreign-invested enterprise by means of base shareholding or investment, and you can make foreign direct investment in China with the legally obtained RMB.

6. Housing provident fund: It is not subject to the restriction of buying a house and can go through the procedures for the withdrawal or transfer of housing provident fund.

7. Tax payment: In accordance with the relevant provisions of Chinese tax laws and regulations and tax treaties, the corresponding tax obligations shall be fulfilled.

8. Domestic travel: Take domestic flights, trains, and accommodation in domestic hotels in China, you can go through the relevant procedures with the permanent residence permit for foreigners, which is convenient and fast.

9. Vehicles with driver’s license: In applying for a motor vehicle driver’s license and registering a motor vehicle, they enjoy the same treatment as Chinese citizens. The “People’s Republic of China Motor Vehicle Driving License” can be applied for with the “Permanent Residence Permit for Foreigners”.

10. Finance: For banking, insurance, securities and futures, and other financial services in China, the “Permanent Residence Permit for Foreigners” can be used as an identity certificate and enjoy the same rights, obligations, and statistical ownership of Chinese citizens.

11. Foreign exchange: Income obtained in China can be exchanged for foreign exchange after paying tax in accordance with the law and holding a tax certificate for external payment issued by the tax department. The “Permanent Residence Permit for Foreigners” can be used as an identity certificate to handle foreign exchange business in accordance with relevant foreign exchange management regulations.

12. Naturalization: To join or restore Chinese nationality, the public security department will simplify and speed up the procedures in accordance with relevant regulations.

All in all, it is to be able to enjoy the same treatment as Chinese citizens. Whether in life or in transportation, it is more convenient and faster.

How to maintain Green Card Status in China?

- You must stay in China for a period, at least 3 months per year.

- The validity period of the Green Card is ten years. After the validity period expires, you need to apply to the Immigration Bureau for a new card. The validity period of the Green Card for minors is five years.

- Must comply with Chinese laws.

Green Card may be cancelled due to one of the following reasons

- Behaviors are harmful to national security and interests.

- Individuals sentenced to be deported by People’s Court.

- Defrauding permanent residence status by providing false materials and other illegal means.

- The accumulative residence in China is less than 3 months per year without approval, or the accumulative residence in China is less than 1 year within 5 years.

How long does it take to approve the application?

- Applying for a Green Card for the first time: processing time for application of green card is 180 days.

- Renew the Green Card: it takes 30 days to renew the Green Card.

How much does it cost?

The application fee for foreigners’ permanent residence application is 1,500 yuan per person, and the fee for foreigners’ permanent residence certificate is 300 yuan per card when the “Foreigner’s Permanent Residence Permit” is issued. A total of 1800 yuan is required to apply for the card.

For foreigners who have obtained permanent residence status in China or apply for a replacement or re-issuance of the “Permanent Residence Permit for Foreigners” due to the expiration of the validity period or the content of the “Permanent Residence Permit for Foreigners”, a fee of 300 yuan per card will be charged for the permanent residence of foreigners.

Permit fee: for foreigners who lost or damaged the “Permanent Residence Permit for Foreigners”, a fee of 600 yuan per card will be charged for the permanent residence permit for foreigners.

The impact of holding a permanent residence permit on income tax

According to the Chinese IIT Law, individuals are categorized into tax-resident taxpayers and non-resident taxpayers.

1) Individuals having no domicile in China and have resided in China for less than 183 days in a tax year, are classified as non-resident taxpayers. Non-resident taxpayers only need to pay individual income tax on income obtained from China.

2) Those who have a domicile in China, or who have no domicile and have resided in China for 183 days in a tax year are identified as resident taxpayers.

It’s not that you need to pay tax on worldwide income if you live in China for more than 183 days in a year, but only when following conditions are satisfied concurrently, then you are categorized into resident taxpayers at the seventh year.

- From 2019, for any 6 consecutive years, the period of residence in each year has reached 183 days.

- No at least one-time departure for more than 30 days in any year within the 6 years of continuous residence for 183 days.

- Has reached 183 days of residence in the seventh year.

Only if above conditions are met concurrently, resident taxpayers are subject to personal income tax on their worldwide income, including that earned in China and in other countries.

Obtaining permanent residence does not require that you must have a domicile in China or reside in China for 183 consecutive days for 6 consecutive years. To maintain the status of China permanent residence, you only need to reside in China for at least 90 days every year. Whether you must pay tax on income obtained from overseas is determined by that if you have a domicile in China and the time you reside in China. For more details of personal income tax liability for Chinese Green Card Holders, please check Tax Implications for Chinese Green Card Holders.

With over 6 years of experience on China Permanent Residence, Aofan Consulting will save you a lot of time for document preparation and make it easy to complete your application. We are here to help you to complete the permanent residence application and guide you all the way to the finish line. Please do not hesitate to contact us at info@intrz.com.